下の記事の英語版で、今のところこんな書きぶりです。

-

-

(実験記事)2022年の米ドル円と2023年の見通し

2022年の振り返り 2022年の米ドル円を一言で表現するならば、日米金利差の大幅な拡大と円安でした。新型コロナウイルス問題やロシア・ウクライナ紛争などを受けて物価は上昇一辺倒となり、FOMC(米連邦 ...

続きを見る

Key Takeaway

- The Japanese Yen weakened drastically due to an increase in the US-Japan interest rate gap.

- Yen gradually rose against the US dollar amid Japanese government intervention and a slowdown in inflation.

- Traders are watching the inflation and the Ukraine-Russia conflict.

USD/JPY in 2022

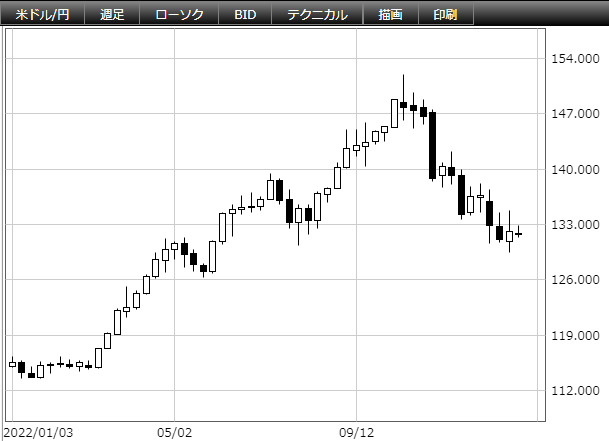

In 2022 traders saw a rapid increase in the US-Japan interest rate gap and weakened Japanese Yen against the US dollar. A severe rise in inflation occurred amid COVID-19 and the Ukraine-Russia conflict.

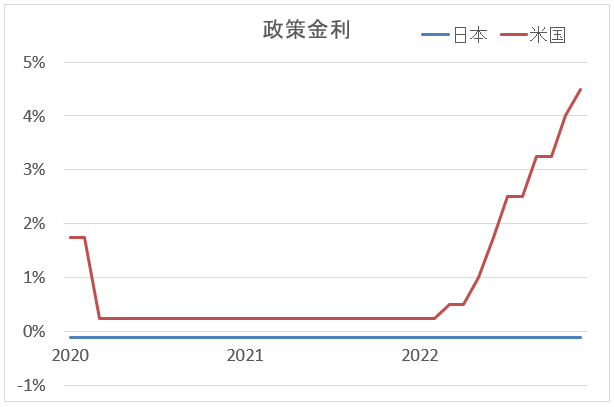

The projections of the Federal Funds Rate at the end of 2022 by the members of the FOMC in March 2022 jumped to 2.0%~3.75%, following 1.0%~2.25% in December 2021, and the interest rates in the US were getting higher and higher. In contrast, the policy interest rate in Japan has remained below zero since January 2015.

The US dollar against the Japanese Yen fell to under the 130 level provisionally due to both the Japanese Government’s intervention in September and October 2022 and the expectation of easing of inflation, after rising drastically to the 151 level, marking the highest in 32 years.

USD/JPY in 2023

In 2023 Traders are watching the inflation and the interest rate gap between the US and Japan. There is the possibility the US dollar vs Yen will increase again if FRB continues to be hawkish.

One of the two important things attracting rising attention is COVID-19. Severe inflation may be easing through the normalization of the economy if the COVID-19 lulls. The other one is the Ukraine-Russia conflict. The grain prices, volatile by the war, may have considerable influence on the foreign exchange market.

Recession in the US also could occur due to the rate hike. In this case, the US dollar may weaken against Yen.

Major Economic Indicators etc

- The policy interest rates in the US and Japan

- COVID-19

- the Ukraine-Russia conflict