This is for writing practice, as of in the morning September 22.

Highlights

- The Fed’s decision sent the USD/JPY above the 148.00 level.

- The USD/JPY couldn’t maintain the momentum to move higher.

- Today traders are focusing on the BoJ’s decision.

Thursday Overview

The FOMC kept the Federal Funds rate unchanged between 5.25% and 5.50%, which was in line with analysts’ estimates. However, the USD/JPY surged above the 148.00 level after the Fed’s decision as traders focused on the dot chart, which showed that the projection for the FF rate at the end of the year 2024 may be higher than previously estimated.

The USD/JPY lost ground after trading sideways in the 148.2-148.4 range during Japan time as traders focused on the stock markets around the world, which saw indices fall. The decline stopped around midnight Japan time.

The Bank of Japan is scheduled to release its interest rate today at around noon Japan time.

USD/JPY Price Action

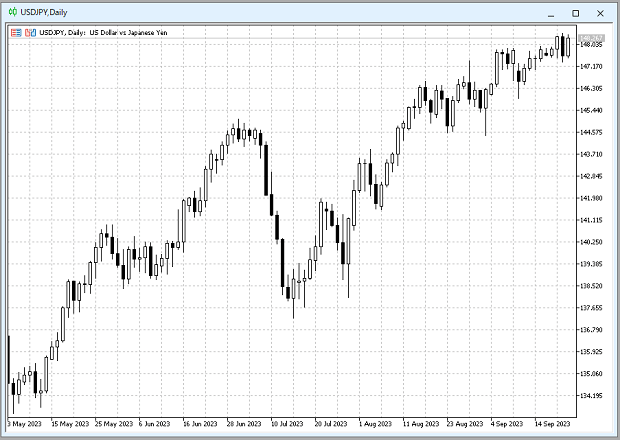

Daily Chart

The USD/JPY has been rising since January 2023, when it bottomed out at the 127.20 level. and has made higher-highs and higher-lows, which means the USD/JPY is in an uptrend. However, the USD/JPY is moving around the 148 level now as it lost its momentum to move higher. In the absence of the BoJ’s intervention, the USD/JPY may settle above the 148.50 level if the right catalyst appears.

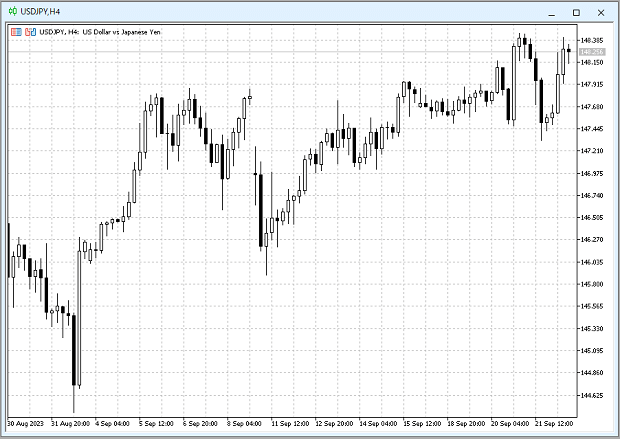

4 Hour Chart

A successful test of the resistance at the 148.00 – 148.50 level could provide USD/JPY with an opportunity to move towards the next major resistance line, which is located at the 150.00 – 152.00. However, the USD/JPY couldn’t maintain its momentum and is now trading between the 147.50 and 148.50 levels.